Financial Well-Being Insurance Protect Your Finances

Shield Your Wealth with Financial Well-Being Insurance! Don't Gamble with Your Finances. Get the Ultimate Protection Today.

The Vital Role of Insurance in Safeguarding Your Financial Well-Being

Insurance, often viewed as a safeguard against unexpected events, plays a pivotal role in securing an individual's financial well-being. It serves as a financial safety net, providing protection against various risks that life may throw at us. In this fast-paced world, where uncertainties are an integral part of life, insurance acts as a crucial tool in managing these uncertainties and ensuring financial stability. This comprehensive guide will delve into the multifaceted role of insurance in safeguarding your?financial well-being insurance, emphasizing its importance in various aspects of life.

Health Insurance Preserving Physical and Financial Health

Health is undoubtedly one of our most valuable assets, but it's also one of the most unpredictable. Medical emergencies and healthcare costs can strike at any moment, potentially wreaking havoc on your finances. Health insurance steps in as the knight in shining armor, covering medical expenses and ensuring access to quality healthcare without the burden of exorbitant bills. It not only safeguards your physical well-being but also prevents catastrophic health events from draining your savings.

Life Insurance: Protecting Loved Ones and Legacy

Life insurance is a poignant expression of love and responsibility. It provides?financial support?to your loved ones in the event of your untimely demise, ensuring that they can maintain their quality of life and meet financial obligations. Whether it's covering funeral expenses, paying off debts, or funding your children's education, life insurance ensures that your legacy lives on, even in your absence.

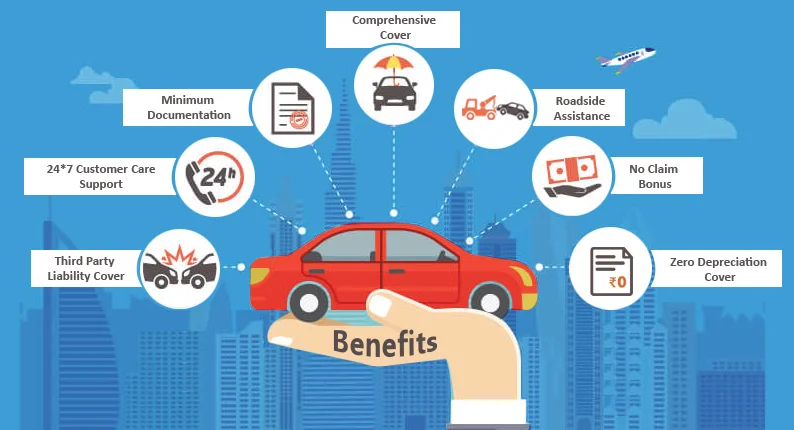

Auto Insurance: Navigating the Road to Financial Security

Automobiles have become an essential part of modern life, but they also come with inherent risks. Auto insurance not only adheres to legal requirements but also safeguards your financial well-being in case of accidents, theft, or damage to your vehicle. It prevents unexpected expenses from derailing your budget and ensures that you can continue to meet your daily transportation needs.

Home Insurance: Shielding Your Biggest Investment

A home is often the most significant financial investment a person makes in their lifetime. Homeowners insurance protects this investment by covering damage or loss due to various perils, including fire, natural disasters, theft, and more. Without this protection, a single calamity could lead to devastating financial consequences, potentially leading to homelessness.

Disability Insurance: Safeguarding Your Income

Your ability to earn an income is one of your most valuable assets. Disability insurance acts as a crucial shield, providing financial support if you're unable to work due to illness or injury. It ensures that you can continue to meet your financial responsibilities, from mortgage payments to daily living expenses, even when your ability to earn is compromised.

Long-Term Care Insurance: Preparing for the Golden Years

As life expectancy increases, so does the likelihood of needing long-term care in old age. Long-term care insurance helps cover the costs of nursing homes, assisted living facilities, or in-home care, which can be?financially draining?without proper coverage. It ensures that your retirement savings remain intact and provides peace of mind in your golden years.

Liability Insurance: Shielding Against Legal Costs

Liability insurance, whether in the form of personal liability coverage or liability within other insurance policies (e.g., auto or home insurance), protects you from the financial fallout of legal claims. Whether it's a lawsuit stemming from a car accident, a slip-and-fall incident on your property, or allegations of professional negligence, liability insurance helps cover legal expenses and potential settlements, safeguarding your assets and financial stability.

Business Insurance: Securing Entrepreneurial Ventures

For entrepreneurs and business owners, insurance is a critical aspect of risk management. Business insurance policies such as general liability, property insurance, and workers' compensation protect the financial health of a business. They ensure that unexpected events, such as lawsuits, property damage, or employee injuries, do not jeopardize the business's sustainability.

Travel Insurance: Mitigating Risks on the Go

Traveling is an integral part of modern life, but it comes with its fair share of uncertainties. Travel insurance covers a wide range of risks, including trip cancellations, medical emergencies abroad, lost luggage, and more. It provides financial protection against unexpected expenses while allowing you to enjoy your travels with peace of mind.

Insurance as an Investment Tool: Building Wealth and Security

Beyond its protective role, certain insurance products, such as cash-value life insurance and annuities, can serve as investment vehicles. These policies allow you to accumulate wealth over time while providing insurance coverage. They offer tax advantages and the potential for financial growth, making them a valuable component of a diversified financial portfolio.

Insurance plays a multifaceted role in protecting your financial well-being across various facets of life. It acts as a shield against the unpredictable, ensuring that unexpected events do not lead to financial ruin. From health and life insurance to auto, home, and disability insurance, each type serves a unique purpose in safeguarding different aspects of your life and assets. Moreover, insurance also extends its protective mantle to businesses, travelers, and investors, offering a wide range of solutions to mitigate financial risks.

Understanding the importance of insurance and making informed decisions about coverage is essential for securing your?financial well-being. By doing so, you not only protect your assets and loved ones but also gain the peace of mind that comes with knowing you are prepared for life's uncertainties. In this ever-changing world, insurance remains a steadfast companion on the journey to financial security and prosperity.

What's Your Reaction?