Reduce Monthly Expenses Practical Tips to Save Money

Slash Bills, Boost Savings! Discover 10 Proven Ways to Reduce Monthly Expenses. Start Saving Now! Practical Money-Saving Tips.

How to Reduce Your Monthly Expenses and Save More Money

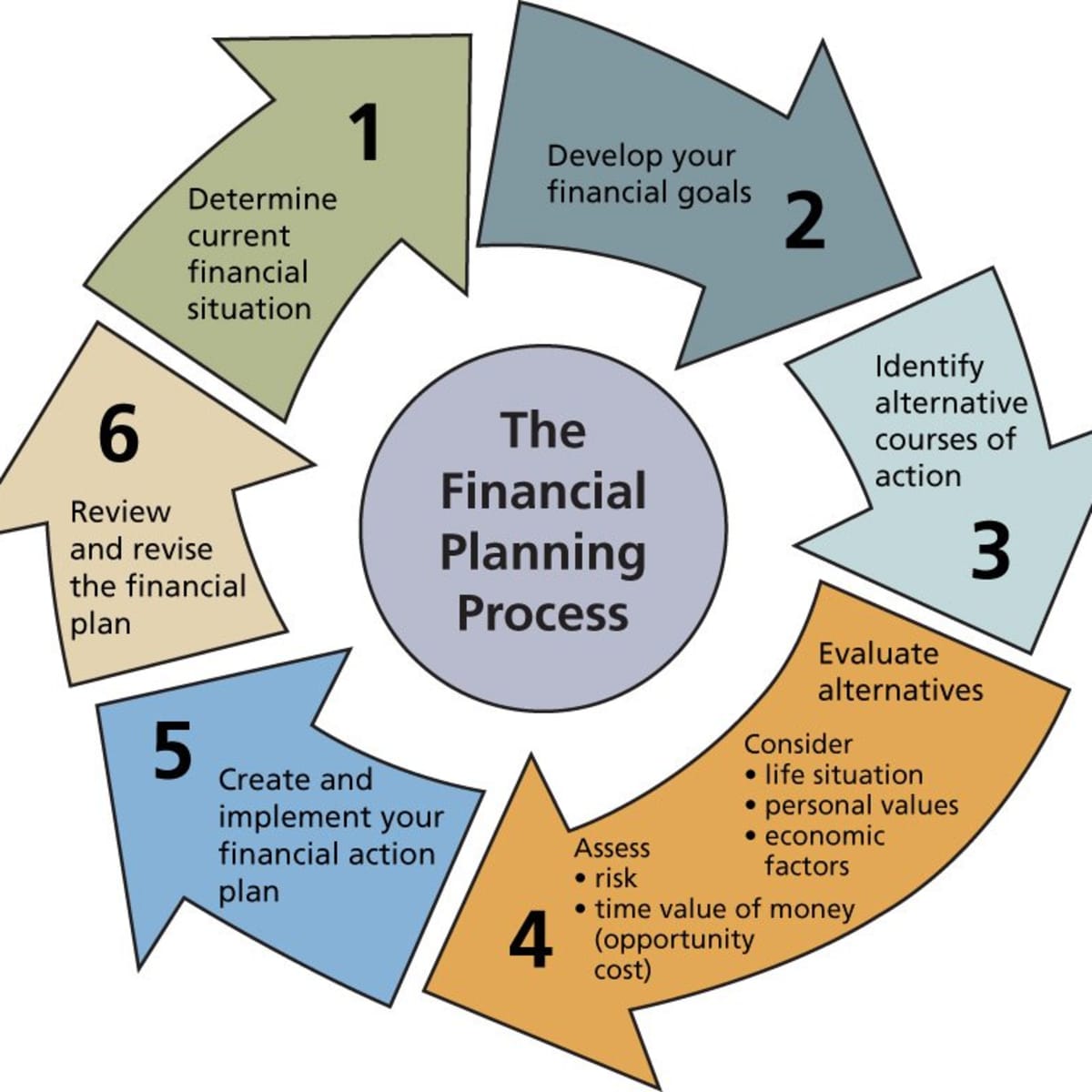

Introduction: In today's fast-paced world, managing finances and saving money is more important than ever. One effective way to improve your financial situation is by reducing your monthly expenses. By identifying areas where you can cut costs and making informed financial decisions, you can save more money and achieve your?financial goals. In this guide, we will discuss various strategies and practical tips to help you?reduce monthly expenses?and increase your savings.

Analyze and Track Your Spending

The first step in reducing your monthly expenses is to understand where your money is going. Create a budget and track all your expenditures for a month. Categorize your spending into essential and non-essential categories. This will give you a clear picture of where you can make adjustments to reduce unnecessary expenses.

Create a Budget: Based on your spending analysis, create a budget that outlines your income and allocates specific amounts for essential expenses such as housing, groceries, utilities, transportation, and debt payments. Allocate a reasonable portion of your income to savings and investments.

Cut Unnecessary Subscriptions and Memberships: Review your subscriptions and memberships, such as streaming services, magazines, gym memberships, and any other recurring charges. Cancel or downgrade services that you don't use frequently or can live without. This can free up a significant amount of money each month.

Cook at Home: Dining out or ordering takeout frequently can be a major drain on your monthly budget. Plan and prepare meals at home to save on food expenses. Buying groceries and cooking for yourself can be much more cost-effective and healthier in the long run.

Limit Impulse Spending: Avoid impulsive purchases by creating shopping lists before going to the store and sticking to them. Consider using cash or debit cards instead of credit cards to help control your spending and avoid accumulating unnecessary debt.

Bundle Services: Explore opportunities to bundle services like internet, TV, and phone to benefit from package discounts. Often, providers offer better rates for bundled services compared to individual plans.

Review Insurance Policies: Regularly review your insurance policies for home, auto, health, and life. Compare rates from different providers to ensure you are getting the best value for your coverage. Adjusting coverage levels or switching to a different provider could potentially reduce your premiums.

Utilize Public Transportation or Carpool: If possible, use public transportation or carpool to work. This can significantly reduce your fuel and parking expenses. Additionally, it's an eco-friendly option that benefits the environment.

Save on Energy Costs: Implement energy-saving measures in your home, such as turning off lights and electronics when not in use, using energy-efficient appliances, and adjusting your thermostat to reduce heating and cooling costs. These small changes can add up to substantial savings over time.

Negotiate Bills and Fees: Don't hesitate to negotiate with service providers like cable companies, internet providers, or credit card companies to lower your bills or waive fees. Loyalty discounts or promotional rates may be available, but you need to ask.

Reduce Credit Card Debt: Focus on paying off credit card debt to avoid high-interest charges. Create a debt repayment plan and prioritize paying off the cards with the highest interest rates first. Once you're debt-free, you can redirect those funds towards savings.

Buy Generic Brands: Opt for generic or store-brand products instead of name brands. Generic brands often offer similar quality at a lower cost, allowing you to save on your grocery bill without sacrificing quality.

Shop Smart and Use Coupons: Look for sales, discounts, and coupons when shopping for groceries or other items. Take advantage of loyalty programs and cashback offers to save money on future purchases.

DIY Home Repairs and Maintenance: Learn basic home maintenance tasks and simple repairs to avoid hiring professionals for every issue. DIY approaches can save you money on maintenance and repair costs.

Opt for Free or Low-Cost Activities: Seek out free or low-cost activities for entertainment, such as hiking, visiting museums on free days, or attending community events. This way, you can have fun without breaking the bank.

Reduce Water Usage: Conserving water not only helps the environment but also lowers your water bill. Fix leaks promptly, take shorter showers, and be mindful of water usage when doing household chores.

Review Cell Phone Plans: Evaluate your cell phone plan to ensure it aligns with your actual usage. Consider switching to a more affordable plan or exploring options with different carriers that offer better rates.

Opt for Pre-Owned or Refurbished Items: Consider buying pre-owned or refurbished electronics, furniture, or appliances instead of brand-new items. These can often be in good condition and come at a fraction of the cost.

Grow Your Own Produce: If possible, start a small garden to grow your fruits and vegetables. This can reduce your grocery expenses and provide you with fresh produce.

Plan Your Errands Efficiently: Combine multiple errands into one trip to save on fuel and time. Planning your trips efficiently can help you reduce transportation costs and increase productivity.

Effectively managing your finances and reducing monthly expenses requires dedication and discipline. By analyzing your spending, creating a budget, and implementing cost-saving strategies, you can save more money and work towards achieving your financial goals. Remember, small changes can make a big difference in your overall financial well-being. Take the initiative to make smarter?financial decisions?and enjoy the benefits of a more secure financial future.

What's Your Reaction?